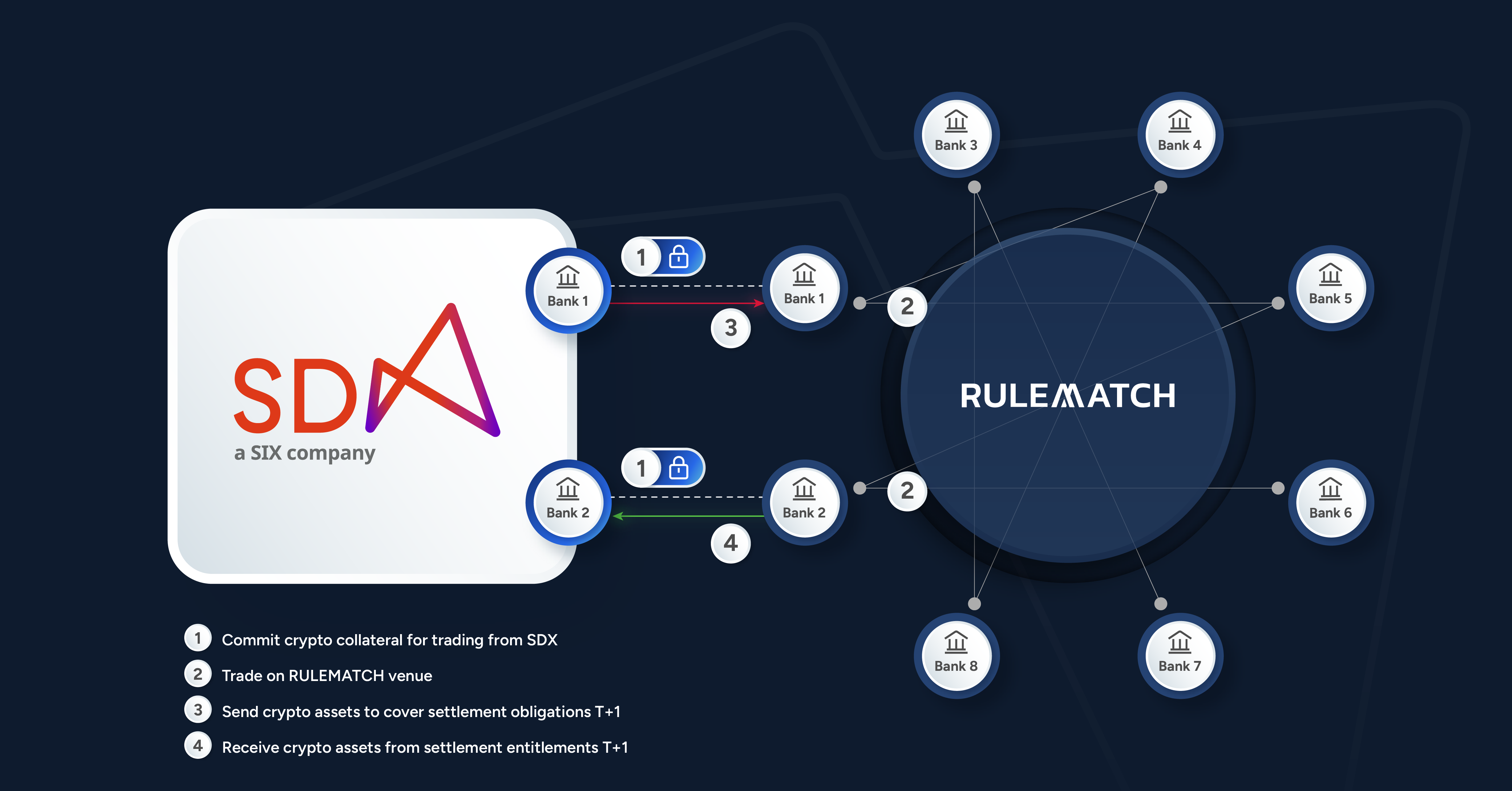

SDX Web3 and RULEMATCH provide an institutional-grade solution for trading, settling, and custody of crypto assets. Combining RULEMATCH’s efficient, low-latency trading platform and post-trade clearing and settlement capabilities with SDX’s highly secure custody services, this solution provides a complete, end-to-end infrastructure for financial institutions who are active in the digital asset market.

With a seamless integration of post-trade clearing and settlement and fast, secure collateral management, institutional investors can trade with confidence, efficiency, and enhanced security.

The RULEMATCH venue utilizes proven trading technology to serve regulated financial institutions who trade among themselves and are bound to a common rulebook for trading and settlement operations. SDX’s highly secure custody services ensures complete transparency and safety for financial institutions.

SDX and RULEMATCH are leading, independent service providers in trading and custody respectively, built exclusively to the needs of financial institutions.

Actively trading institutions do not need to pre-fund trades and benefit from the efficiency of netting. They can hold crypto assets off-venue with SDX and make a single settlement transfer per asset and per trading day.

RULEMATCH is a pure market operator and is never counterparty in trading and settlement. As a dedicated infrastructure provider, SDX is focused solely on institutional-grade custody services.

SDX offers a transparent, AuM-based fee model without high fixed costs, while providing services at the highest level of security and reliability. RULEMATCH participants can trade with trading fees between 2-8 bps.

Participants can trade at speeds down to 25 microseconds and benefit from being able to adjust crypto collateral positions within SDX in seconds, without the delays and risks associated with on-chain transactions.

The combined trading, settlement and custody services of SDX and RULEMATCH offers a complete, end-to-end solution that meets the requirements of financial institutions.

Here’s why you should choose SDX and RULEMATCH:

The SDX and RULEMATCH solution is ideal for regulated financial institutions and their institutional clients who are looking to build an active business with attractive profit margins in the digital asset space, including:

Contact us today to explore how our end-to-end solution can enhance your institution’s efficiency, security, and compliance.

SIX Digital Exchange

Pfingstweidstrasse 110

8005 Zürich, Switzerland

+41 (0)58 399 89 40

digital.support@six-group.com