SDX and SIX Securities Services bring to market the new Digital Collateral Service (DCS), specifically designed to enable the usage of selected crypto assets as collateral alongside traditional collateral. This service leverages the use of crypto assets as collateral to minimize counterparty risk in investing and trading.

DCS provides a single platform for management of traditional securities and crypto collateral, simplifying operations for collateral providers and takers. Counterparties, being investors or trading partners, can have their crypto collateral safely stored with SDX, where it is fully protected and backed.

This product is jointly delivered by SIX Securities Services and SDX, leveraging SIX’s role as a bankruptcy-remote regulated collateral agent. This ensures your exposures are fully collateralized, even in adverse market conditions, and safeguarded against the insolvency of collateral providers (e.g. ETP Issuers, Trading Firms, Prime Brokers, Asset Managers) for any given collateral taker (e.g. Banks, Clearing Firms, Exchange/Trading Venues, Insurers).

Our fully integrated solution empowers product issuers, traders, brokers, and market makers to optimize their collateral usage,

whether it’s crypto or traditional securities, with built-in risk management safeguards.

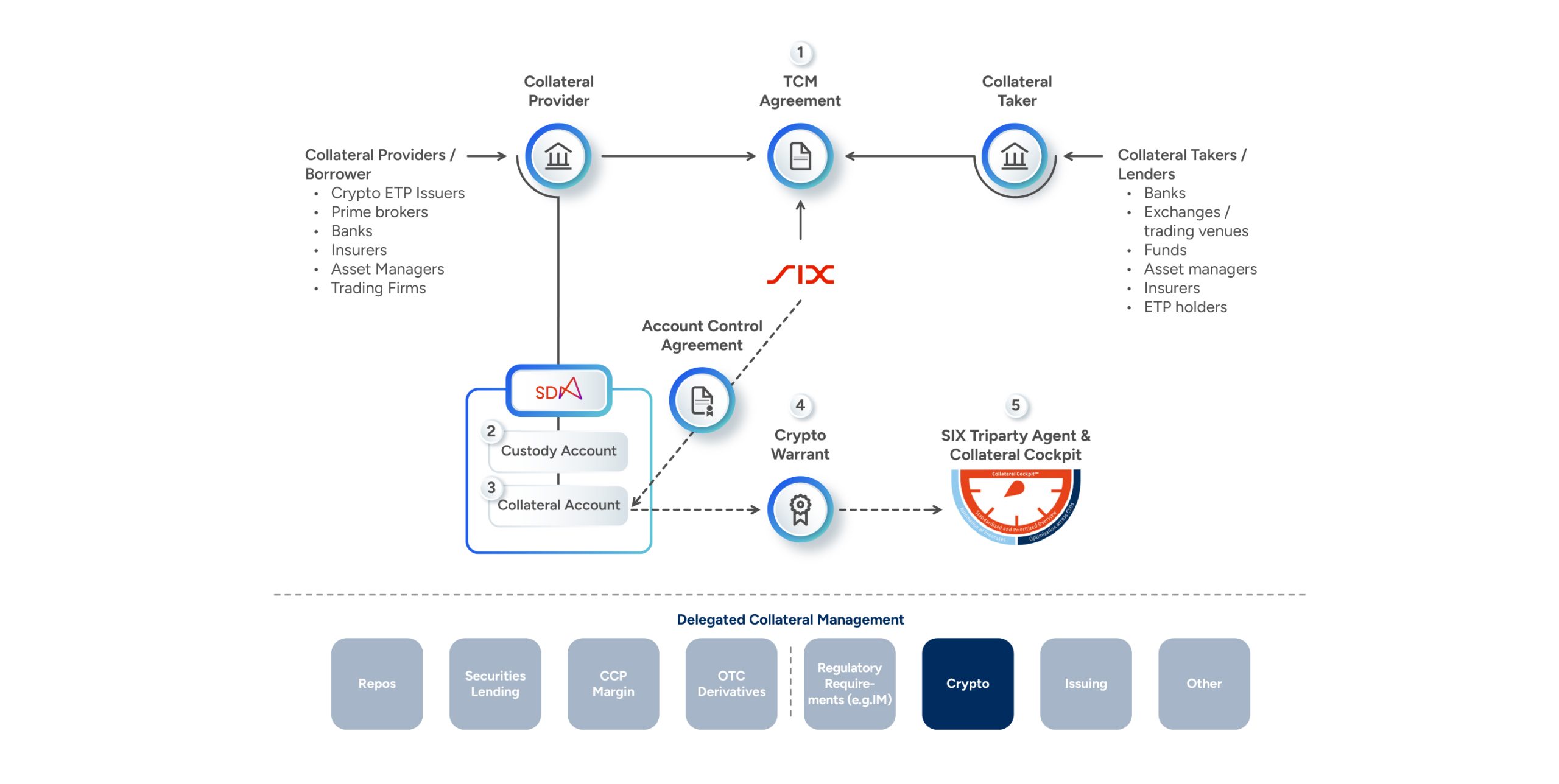

Triparty Collateral Management (TCM) agreement outlines the terms and conditions for collateralization of exposures between Collateral Providers & Collateral Takers.

Segregated crypto account at SDX Web3 Custody ensures that assets are safely stored and available for collateralization purposes.

Crypto collateral account at SDX Web3 Custody. SIX has exclusive control over the collateral account via the Account Control Agreement and ensures exposures are fully collateralized.

Issued by collateral provider through the SIX platform representing crypto collateral, which can be pledged as securities collateral and is viewable in the SIX Collateral Cockpit.

SIX acts as neutral party responsible for collateral management, including moving collateral between parties, default management and ensuring compliance with the TCM agreement.

Part of SIX Group – Certainty of top-tier security and compliance via SDX, operating under the highest standards of a FINMA-regulated FMI.

Crypto Custody – Trusted institutional Swiss counterparty for both traditional securities and crypto assets.

Unified Management – A simple, secure and integrated collateral management solution for traditional securities and crypto assets.

SIX Digital Exchange

Pfingstweidstrasse 110

8005 Zürich, Switzerland

+41 (0)58 399 89 40

digital.support@six-group.com